It’s funny. For most of the near-30 years personal computers have been common and the 20+ years broadband connections have been the norm, investors have been using these tools to trade. Computer programmers have spent this time perfecting their trading platforms too. It’s no surprise that the industry’s leveraged these developments to come up with some incredibly sophisticated algorithms too. The funny part? The simpler tools are still the superior tools when the end-goal is making money.

That’s a tough idea for some traders to digest. The simpler a trading system is, the more likely it is that other people are using it, rendering it less effective. In other words, the more crowded a trade is, the more prospective profits are divvied up. The more sophisticated or rare a trade prompt is, conversely the more likely it is that trader has stumbled upon a “tell” that nobody else is trading. That means the signal’s potential is all your own. Factor in how any conceivable chart-based trading signal can be turned into a full-blown trading alert these days, it’s possible every trader could have their very own customized strategy to plug into without necessarily working against other active traders.

The simpler technical tools still often make for better trading strategies for two simple reasons though. One them is, they’re easily testable. The other is, their overall results are easily reproduced. The more sophisticated or multi-faceted a chart-based algorithm is, the less likely it is it will actually generate a meaningful number of trading cues.

One of Big Daddy’s favorite, highly-proven signal generators is a moving average line, but with a slight twist. That twist is, rather than the simple moving average most commonly seen on a stock’s chart, we prefer an exponential moving average. That just means the more recently-generated data used to calculate a moving average is given greater weight in that calculation, while the older data used to come up with a moving average is de-weighted.

In other words, an exponential moving average (or EMA) tends to better reflect the recent changes in a stock’s price than a simple moving average (or SMA) does.

Clear as mud? A visualization will help explain the idea.

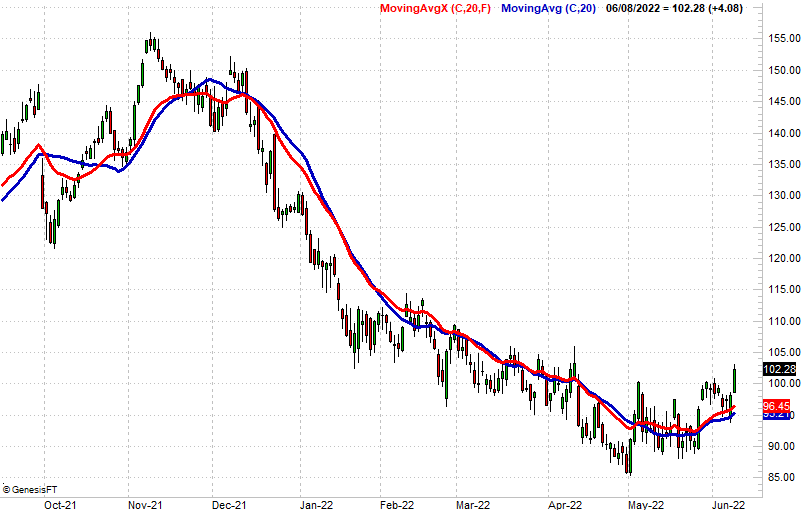

The daily chart of CarMax (KMX) below isn’t just a record of its daily opens, highs, lows, and closes. Overlaid this daily data – plotted in blue – is a simple 20-day average of each day’s past 20 closing prices. It’s “moving” in the sense that a slightly different 20 days are considered in each day’s calculation of that past 20 closes. In step with CarMax shares’ rebound in the latter portion of the timeframe in question, the 20-day moving average is starting to point higher rather, reversing a long-term downtrend.

Here’s the same chart, but with one addition. On the daily chart of CarMax shares below we’ve added an exponential 20-day moving average line to the mix, in red. As you can see, the EMA tends to move a little faster, and more closely follows the stock’s daily change in its closing price. That’s because the calculation of the average assigns more weight to the recent closes, and less weight to the closing prices nearer 20 days back.

It seems like such a modest difference that it doesn’t really matter, and sometimes, it doesn’t. Sometimes though, the most modest of nuances can make a world of difference to your bottom line.

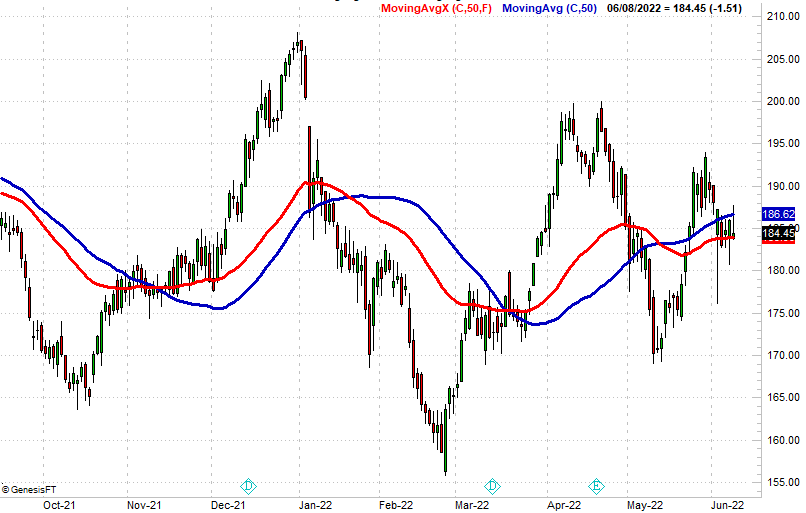

Here’s another comparison of a simple moving average and an exponential moving average. In this case we’ve switched the stock in question to Crown Castle International (CCI), but more than that are comparing 50-day simple moving average to its 50-day exponential moving average, which shows us a more apparent divergence between the two types of moving average lines.

Fine, but how exactly does Big Daddy turn exponential moving averages into trades? That’s the cool part about this very basic technical indicator — there are lots of different ways to use them, and we use them in more ways than one.

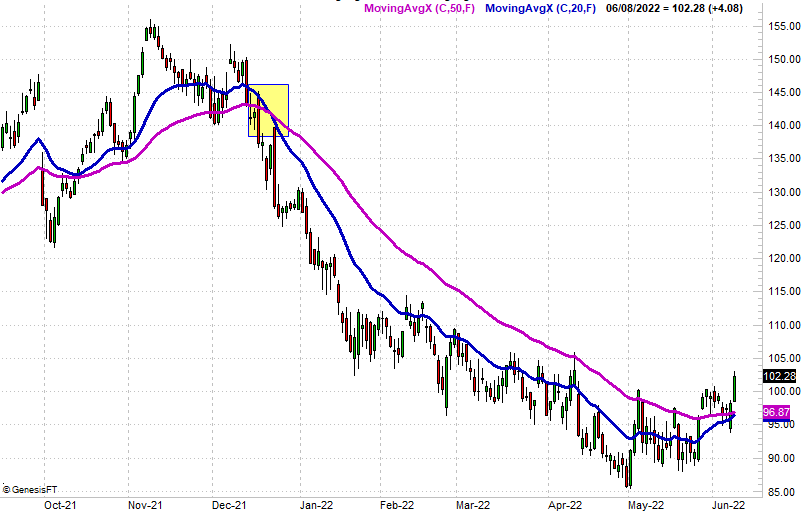

One means of using them is using crosses of them to trigger a trade. Take the aforementioned CarMax as an example. A cross of the stock’s 20-day EMA below its 50-day EMA in December correctly identified a major bearish move that would have made for an outstanding put option trade. Also notice how this use of its exponential moving averages as trade signals wouldn’t have resulted in an errant fake-out bearish signal in the few weeks leading up to December’s bearish cross-under.

Another way of plugging into the trading potential of exponential moving averages is using them to filter out trades triggered by a completely different trading cue. That is to say, unless a stock is above or below a particular EMA line, those signals are disregarded.

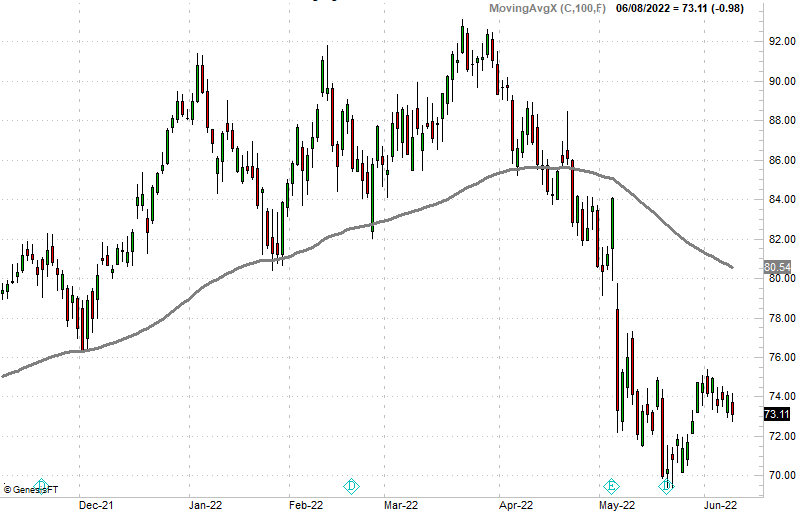

This sort of exclusionary rule certainly would have been helpful for anyone counting on one of the stumbles Cognizant Technology Solutions (CTSH) dished out for the majority of the time represented on its daily chart below. Several times since November the stock’s acted like it was going to make a major pullback, but didn’t until. Once it broke down in April though, it broke down in a big way. Notice how the sellers could never do any real damage to the stock until it was under its 100-day exponential moving average line. Just by not taking any bearish trades (put options) until the stock was under its EMA line, you would have avoided several misfires.

Or, there’s an even simpler use of exponential moving averages that would have worked out well with Cognizant’s 100-day EMA. That is, the exponential moving average is the signal line in and of itself. A cross below it is a sell, or a bearish cue, and a cross above it is a buy, or bullish signal. Sometimes it really is that easy!

At Big Daddy Options we frequently use the Big Daddy EMA cross, just because it’s so proven and so easy to apply. Its success is also easy to evaluate, and our signals can be tweaked as needed to work better in an ever-changing market environment. If you’d like to learn more about our exponential moving average line-based trading strategies, just go here.