Want Exponential Trading Gains? Use Exponential Trading Tools.

It’s funny. For most of the near-30 years personal computers have been common and the 20+ years broadband connections have been the norm, investors have been using these tools to trade. Computer programmers have spent this time perfecting their trading platforms too. It’s no surprise that the industry’s leveraged these developments to come up with some incredibly sophisticated algorithms too. The funny part? The simpler tools are still the superior tools when the end-goal is making money.

That’s a tough idea for some traders to digest. The simpler a trading system is, the more likely it is that other people are using it, rendering it less effective. In other words, the more crowded a trade is, the more prospective profits are divvied up. The more sophisticated or rare a trade prompt is, conversely the more likely it is that trader has stumbled upon a “tell” that nobody else is trading. That means the signal’s potential is all your own. Factor in how any conceivable chart-based trading signal can be turned into a full-blown trading alert these days, it’s possible every trader could have their very own customized strategy to plug into without necessarily working against other active traders.

The simpler technical tools still often make for better trading strategies for two simple reasons though. One them is, they’re easily testable. The other is, their overall results are easily reproduced. The more sophisticated or multi-faceted a chart-based algorithm is, the less likely it is it will actually generate a meaningful number of trading cues.

One of Big Daddy’s favorite, highly-proven signal generators is a moving average line, but with a slight twist. That twist is, rather than the simple moving average most commonly seen on a stock’s chart, we prefer an exponential moving average. That just means the more recently-generated data used to calculate a moving average is given greater weight in that calculation, while the older data used to come up with a moving average is de-weighted.

In other words, an exponential moving average (or EMA) tends to better reflect the recent changes in a stock’s price than a simple moving average (or SMA) does.

Clear as mud? A visualization will help explain the idea.

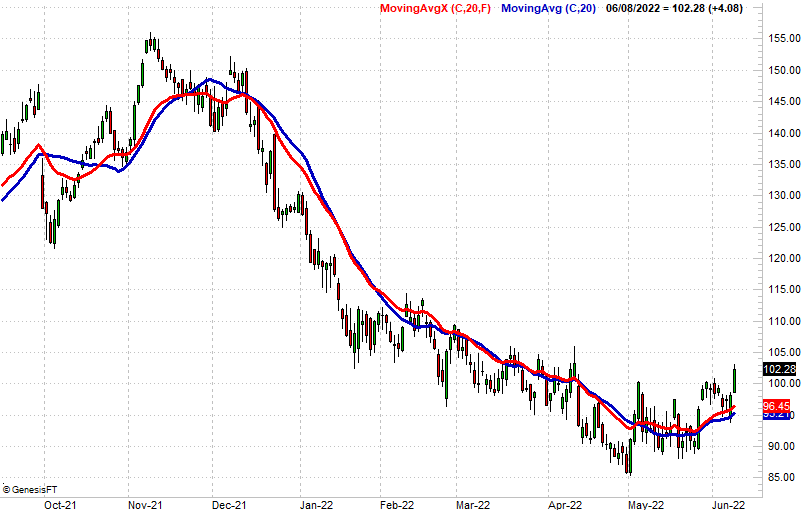

The daily chart of CarMax (KMX) below isn’t just a record of its daily opens, highs, lows, and closes. Overlaid this daily data – plotted in blue – is a simple 20-day average of each day’s past 20 closing prices. It’s “moving” in the sense that a slightly different 20 days are considered in each day’s calculation of that past 20 closes. In step with CarMax shares’ rebound in the latter portion of the timeframe in question, the 20-day moving average is starting to point higher rather, reversing a long-term downtrend.

Here’s the same chart, but with one addition. On the daily chart of CarMax shares below we’ve added an exponential 20-day moving average line to the mix, in red. As you can see, the EMA tends to move a little faster, and more closely follows the stock’s daily change in its closing price. That’s because the calculation of the average assigns more weight to the recent closes, and less weight to the closing prices nearer 20 days back.

It seems like such a modest difference that it doesn’t really matter, and sometimes, it doesn’t. Sometimes though, the most modest of nuances can make a world of difference to your bottom line.

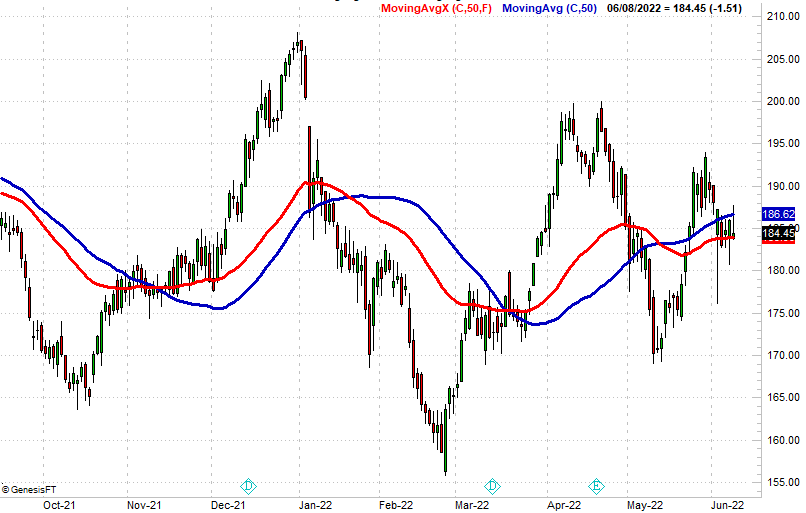

Here’s another comparison of a simple moving average and an exponential moving average. In this case we’ve switched the stock in question to Crown Castle International (CCI), but more than that are comparing 50-day simple moving average to its 50-day exponential moving average, which shows us a more apparent divergence between the two types of moving average lines.

Fine, but how exactly does Big Daddy turn exponential moving averages into trades? That’s the cool part about this very basic technical indicator — there are lots of different ways to use them, and we use them in more ways than one.

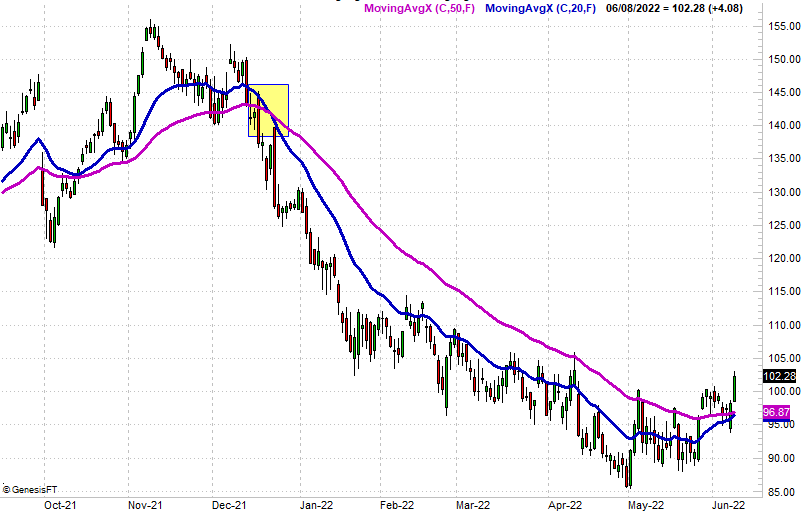

One means of using them is using crosses of them to trigger a trade. Take the aforementioned CarMax as an example. A cross of the stock’s 20-day EMA below its 50-day EMA in December correctly identified a major bearish move that would have made for an outstanding put option trade. Also notice how this use of its exponential moving averages as trade signals wouldn’t have resulted in an errant fake-out bearish signal in the few weeks leading up to December’s bearish cross-under.

Another way of plugging into the trading potential of exponential moving averages is using them to filter out trades triggered by a completely different trading cue. That is to say, unless a stock is above or below a particular EMA line, those signals are disregarded.

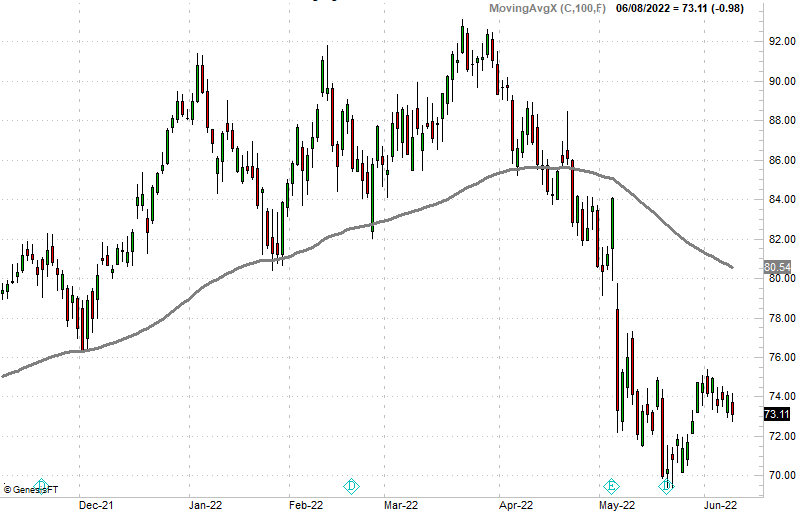

This sort of exclusionary rule certainly would have been helpful for anyone counting on one of the stumbles Cognizant Technology Solutions (CTSH) dished out for the majority of the time represented on its daily chart below. Several times since November the stock’s acted like it was going to make a major pullback, but didn’t until. Once it broke down in April though, it broke down in a big way. Notice how the sellers could never do any real damage to the stock until it was under its 100-day exponential moving average line. Just by not taking any bearish trades (put options) until the stock was under its EMA line, you would have avoided several misfires.

Or, there’s an even simpler use of exponential moving averages that would have worked out well with Cognizant’s 100-day EMA. That is, the exponential moving average is the signal line in and of itself. A cross below it is a sell, or a bearish cue, and a cross above it is a buy, or bullish signal. Sometimes it really is that easy!

At Big Daddy Options we frequently use the Big Daddy EMA cross, just because it’s so proven and so easy to apply. Its success is also easy to evaluate, and our signals can be tweaked as needed to work better in an ever-changing market environment. If you’d like to learn more about our exponential moving average line-based trading strategies, just go here.

When Trading Options, Less Can Be More: Set It and Forget It

As most veteran traders can attest, speculating on a stock’s next move can be much more difficult when there’s actual money on the line. Hypothetical bets are easy, and often profitable. When actually taking on a true monetary risk though, perceptions change, and confidence can wane. Sometimes this indecision can even steer you into exiting a trade shortly after it’s entered, only to miss out on what eventually ends up being the right call.

There’s a psychological term for the phenomenon… a couple of them, actually. Cognitive dissonance describes the mental discomfort linked to holding two conflicting beliefs — in this case, two different trading outcomes that both seem distinctly and equally possible — while ordinary fear can warp an otherwise-unbiased view of what a stock’s likely to do next. When you combine the two forces without taming either, you’ll eventually stumble into a trading disaster.

If you’re reading this then you’ve probably already heard plenty of tips about how handle this complicated psychology of trading. And, there’s no reason to dismiss those tips, particularly if you find them helpful.

Such psychological self-management, however, looks right past trading’s most common pitfall. That’s the fact that your trading process is more important than your stock-picking prowess.

That’s a tough idea for some people to swallow, and understandably so. Most of the trading industry’s tools are aimed it identifying budding trends nobody else has spotted yet. It feels as if identifying the next move is not only where the money is made, but the aspect of the trading business that you should be most focused on.

That’s just not the case though. You should be just as focused on — if not more focused on — your trade selection and position-management approach. Namely, you should take the risk of emotionally-charged decisions completely off the table by automating your entries as well as your exits.

In other words, “set it and forget it.”

It’s admittedly tough to do. Active traders typically prefer to manage the key aspects of any trade, like deciding when to pull the plug on a losing trade, or deciding when to lock in a profit. It feels good to be able to exert this degree of control.

It’s also dangerous though. Again, emotions like panic, euphoria, and the sheer fear of missing out on a gain can spur misguided entries and exits.

Big Daddy Options’ trading strategies are built from the ground up to circumvent these risks by pre-establishing the two key parameters of any trade. Those are the price target, and if necessary, a stop-loss level.

Think of a stop-loss as a safety net. This is a pre-determined price at which an exit is automatically made on a trade that’s not moving in the predicted direction. These trading instructions can be put in place as soon as the position is opened, and left in place as long as the option is held. You don’t have to actively send trading instructions when you want to pull the plug on a trade; you don’t even have to be watching the trade. These exits happen entirely on their own. This technique removes emotion from the mix, which is important, since feelings like regret or denial can erroneously convince you to stick with a trade you clearly should get out of.

As for profit targets, or sell-limits, these are exactly what they sound like… an automated exit when an option trade achieves the sort of gain the chart and trade signal initially suggest is possible. By taking this on-the-fly decision off the table, the greed-driven risk of trying to squeeze out a little more profit is eliminated as well.

This is no small matter. Many sizeable winning trades have turned into smaller wins — or even outright losers — simply because traders talked themselves out of ignoring their initial profit-taking plan. Like stop-losses, Big Daddy’s profit targets are established right at the same time a new trade is opened.

The great irony is, such a hands-off approach actually allows you to trade more confidently rather than less confidently. When your purchase signals are proven and optimized, you can act on all of your trading prompts as needed… without fear of second-guessing. Your safety net is already in place at the onset of a trade, as is your target. Both are already based on the algorithm driving your trades, and already tested to maximize your reward while minimizing your risk. The key of course is building a winning trade-generating system that’s proven by back-testing, and can replicate trade suggestions over and over again.

Bonus: By automating your entries and exits, you free up your time to do things other than watch computer screens all day long. Less can be more. And for most options traders, it should be.

To learn more about the Big Daddy stop and target-setting strategies, click here.

Got Trading Leverage? This Overlooked Type of Option Offers It in Droves

It’s a trader’s top conundrum. A stock’s next near-term move is crystal clear, but there’s not enough potential net-movement to really matter. Since trading is all about managing risks and rewards, a lack of reward dictates you skip taking your shot.

There’s a simple solution most folks don’t know about, or are at least too unfamiliar with to try. That’s weekly options.

Veteran traders likely know that most equity (and index, and exchange-traded fund) options expire on the third Friday of every month, although they can be issued months and even years before their expiration dates. Options are attractive trading instruments, of course, because they can magnify the price changes of a stock or index. Depending on traders’ risk tolerances, sometimes these trades can achieve tenfold leverage, if not more. And for a long, long time, there were enough option choices to meet every conceivable need.

As the market’s matured and become more volatile though, traders’ needs have grown. Like their monthly and quarterly counterparts, weekly options were launched in 2005 to offer traders a way of leveraging even the smallest and shortest-term moves. Notably, weekly options provide even more trading leverage than their more conventional monthly and quarterly counterparts.

The big difference between weeklies and the others? Most weekly options are typically issued and begin trading on Thursday and expire the following Friday (although a handful of the market’s most-traded stocks continually support weekly options expiring one, two, three, and even four weeks out).

Same-week versus next-week

There are only two (related) key terms you really need to understand with weekly options, although neither is official. Those terms are same-week and next-week. A typical weekly option is a next-week option during the week of the Thursday it’s issued, and a weekly option becomes a same-week weekly option in the week following its usual Thursday issue.

And yes, there’s an important distinction between same-week and next-week options. The options closer to expiration than their comparable counterparts are less responsive to movement in the underlying stock, and yet they also suffer greater daily loss of value due to their shortening useful life. The thing is, they may still be worth trading despite their disadvantage.

The table below puts this tradeoff in perspective, comparing weekly Amazon (AMZN) same-week options set to expire just four days from now – issued a week ago – versus the identical next-week weekly options issued today that will expire eleven days from today. With Amazon shares priced at $2426.40, the calls with a strike price of $2410 expiring at the end of this week are valued at $57 apiece ($5700 per contract), while the $2410 calls expiring at the end of next week cost $95, or $9500 per contract.

(insert attached image here)

You’re seeing that correctly. Traders are paying an extra $3800 per call to have an extra week to cash in on whatever move is brewing for Amazon shares. That’s a lot of added cost, although the additional cost may be a fully justified. See, pricing isn’t the only key difference between these two weekly options. Also note the sizeable difference between the so-called “greeks” theta and delta.

Not all the same… at all

In simplest terms, delta is how much the value of the option in question changes for every dollar the price of Amazon stock itself changes. If Amazon’s value rises from $2426.40 to $2427.40, the call option expiring in four days only sees price growth of $0.52, or $52 for a per contract. The $2410 call contract expiring in eleven days, however, will improve by $56 per contract with just a $1 increase in the price of Amazon shares. Better still, the more Amazon’s price rises and the deeper these calls move into the money, the bigger their respective deltas become. Such a move will help both options, to be clear, but it will help the latter one by more… in addition to giving you an extra week’s worth of time to capitalize on any brewing move from Amazon shares.

The longer-term option has another advantage over the calls expiring just four days from now. That’s a lower theta, or less time decay. With a theta of $6.19, the option with a nearer-term expiration is losing $6.19 per day solely due to the passage of time. The $2410 calls set to expire eleven days from now, however, are only losing less than $4.00 per day — $400 per contract — just due to time.

Don’t get too excited about the longer-term option among these two choices though. Again, the more responsive, lower-theta weekly option costs 66% more than the nearer-term call expiring at the end of this week does. Look at it in risk-versus reward terms: The cheaper, same-week options actually offer a great deal more leverage due to their lower cost. You’re just paying more for more time to make money on this particular trade.

And yes, the pricing, time decay, and delta figures factor the exact same way with weekly put options.

The secret to success

The usual trading tradeoff still applies here. In this case, if you’re buying same-week options you need quick moves now, but the rewards can be tremendous. With next-week options, you’re not getting as much leverage now, but you are gaining price stability, and time. Both choices can pay off nicely depending on how matters take shape once you’re in a position.

The trick? Selecting the best weekly option for a particular trading scenario.

This is easier said than done, of course. Given that proper trade selection is typically the difference between winning and not winning the weekly options game though, this is how smart traders should be spending a great deal more of their analytical time than most of them are.

If you’d like help in mastering the most critical step in selecting trades on these highly leveraged instruments, click here to see how Big Daddy chooses between same-week and next-week options.

*In the week of the third Friday of the month when regular monthly or quarterly options are scheduled to expire or the market is closed, weekly options typically expire on Thursday of the week following their issue.